Options: Models, Spreads, and you will Exposure Metrics

Anyone often get an used selection for protection from a decrease from the price of an inventory or ETF. Buyers trying to find earnings possibly looking for a shielded label method. Regarding possibilities, it can be very easy to rating overwhelmed by slang. Watch so it movies to learn the fundamentals as opposed to a whole new words.

Boosting Winnings: An extensive Alternatives Change Approach

Such as, if you purchase an agreement at the a hit cost of $fifty a percentage, you wouldn’t score lower than bitwave-co.com one to matter, even if the asset’s market value decrease so you can $0 (the choice creator try obligated to choose the shares). Simultaneously, should your asset’s well worth leaps past its current market worth, you could favor never to exercise your substitute for sell and you will possibly gain selling the fresh shares outright. The brand new struck price is the fresh predetermined price from which the underlying investment can be purchased otherwise sold.

Influence & Risk

Doing so makes it possible to have the hang away from alternatives change and you will find prospective pluses and minuses instead in reality putting money on the line. Not just do you want to discover different choices exchange steps and also acquire an entire picture of the chance in it. What if your own premium is $ten for every share, and the alternatives package is for the quality a hundred offers. It means you will have to pay a total superior from $step 1,000 for the alternative. Choices are a form of derivative, which means that it get the value out of an underlying asset.

- Today the newest homebuyer need to pay the market industry rates as the bargain features ended.

- And associated banking companies, Players FDIC and completely possessed subsidiaries of Financial from America Business (“BofA Corp.”).

- This indicates the potential for money using the control you to options exchange lets.

- NerdWallet cannot and should not make sure the precision or usefulness out of one advice concerning your personal points.

Speculating that have a good call choice—as opposed to buying the inventory outright—wil attract for some people since the options render influence. An out-of-the-money call choice may only costs a number of cash if you don’t dollars weighed against a complete price of a good $a hundred inventory. The options to the lower hit rate will be the minimum high-risk but also the most costly.

If your stock speed really does boost, you might exercise your option and make a return. Should your organization you possess alternatives for is in public places traded, the value of your own stock options utilizes the current worth of the stock. Estimate simply how much it will be worth if you were to find or promoting what number of shares that you have an alternative to possess from the personal price. Following, calculate exactly how much it could be really worth to shop for otherwise offer an identical number of shares from the price of your choice. Continuing the new analogy, an investor expenditures five label contracts to possess January at the $150. In case your stock exceeds $150 in the conclusion, the fresh individual can acquire five-hundred offers at that price.

This gives the best however a duty to find an investment during the a fixed price. And, possibilities need a thorough knowledge of cutting-edge tips, and you may lack of knowledge is enhance dangers, leading to significant problems and you will financial losings. Intended volatility (IV) is probably the most challenging to assess, however it is important to discover to own alternatives investors.

We do not highly recommend certain issues or team, but not will get receive a commission regarding the organization i provide and ability. Whoever offered me personally the choice features one to because the cash, and in addition they support the house. Here is the worth of the option, if or not you’lso are the consumer or even the vendor. Along with the Greeks, implied volatility (IV) is another essential part of an alternative’s rates. A change in IV by yourself have a remarkable influence on the expense of an alternative. In conclusion a position, come across “intimate open” from the action loss and you will enter their price and acquisition type of.

As well, the fresh magnitude of your own move has to outstrip what the alternatives business cost within the thru implied volatility. But not, of many active options traders never ever want to contact the root offers on their own. As an alternative, they buy and sell choices – either in numerous combos called “spreads” – to the intention of benefiting from changes in the fresh superior, or cost, of the solution deals.

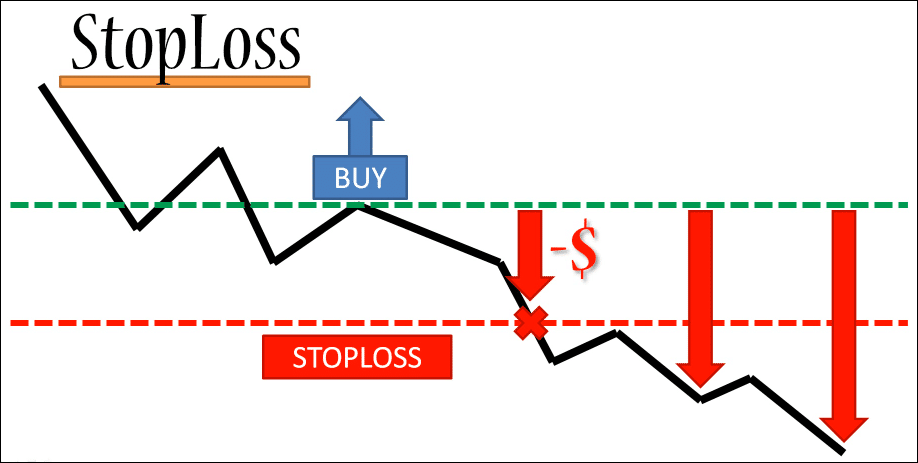

Fast-toward the fresh expiration go out, where now, stock A need risen up to $70. It name option would be value $20, since the stock A great’s pricing is $20 more than the fresh strike price of $fifty. By comparison, a trader perform cash in on a put option if your root inventory was to fall below his hit price from the conclusion go out. Traders bring combinations of long and short alternative positions, with various struck rates and you will expiration schedules, for the purpose of extracting profit from the option premiums which have limited chance. Such as, if you very own shares away from a pals, you can pick lay choices to mitigate possible losses in the knowledge the fresh inventory’s rates decreases. This is one to reason why options for broad field standards, including the S&P five hundred, are generally put since the a good hedge to possess potential refuses on the industry for the short term.

Not merely are you currently obliged to invest a premium when purchasing options, however you may also have to expend a commission to your agent and you will quick regulatory charges. Due to this, it helps make sense so you can weighing probably can cost you up against prospective winnings and loss, before purchasing a choice offer. Otherwise their cash could end upwards are lower than you thought, otherwise their loss higher than dreamed. For the consumer away from a choice, the most obvious threat is that the root resource cannot flow regarding the desired guidance, forcing these to allow package end meaningless. Have this occurs usually enough, and it can add up to larger loss — possibly over for many who simply bought and you will stored the root assets.